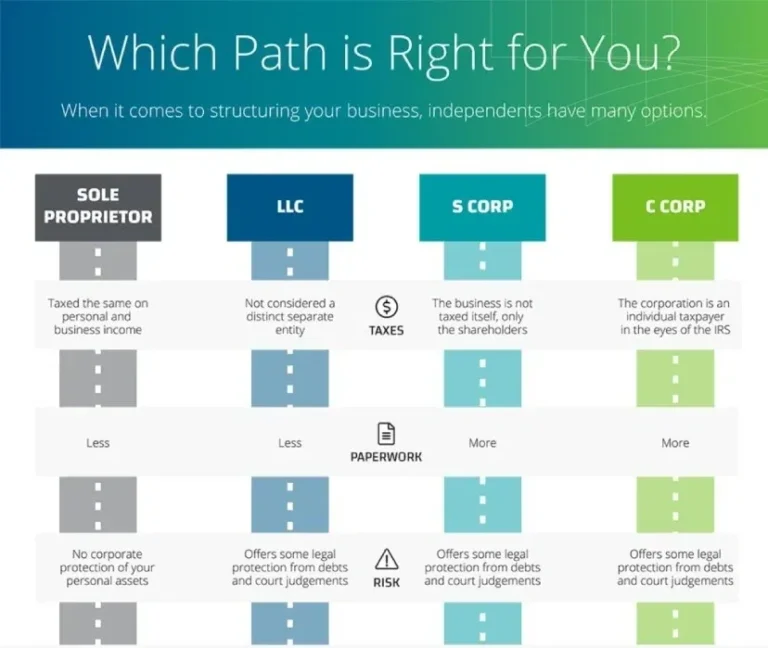

- Sole Proprietorship – A Sole Proprietorship is easy to form, but it offers little liability protection, funding options, and opportunities for future growth.

- Partnership – A General Partnership is the most basic form of partnership. It is comparable to a sole proprietorship, but it must have at least two owners or partners.

- C Corporation – The C Corporation is the most common form of corporate entity. The C Corporation is owned by shareholders. The shareholders elect a board of directors to create and direct the high-level policies of the business.

- S Corporation – An S Corporation is different from a C Corporation in two significant ways: (1) An S Corporation makes an election to be taxed as a “pass-through entity” and (2) An S Corporation has limitations on ownership.

- Limited Liability Company – A Limited Liability Company is a popular business structure because it combines the liability protection offered by incorporation while retaining some of the tax advantages of a Partnership or Sole Proprietorship.

- Professional Corporation – Individuals who provide a professional service can also benefit from forming a Professional Corporation. Where a business provides a professional service, most states have special filing requirements when incorporating.

We have partnered with CorpNet to provide our clients direct access to expert guidance on choosing with entity is right for you at a fraction of the cost!

MJs Bookkeeping is available as your liaison for a simplified approach! Send us a message to get started!